Buy now, pay later services do just what they say on the packet. You get to slip straight into the latest fashions, and providing you pay within the allotted time, you pay 0% interest. So far, so good.

But, like the proverbial free lunch, it’s worth looking closer. ASIC’s report1 into this rapidly expanding sector looks at potential costs and pitfalls, as well as the benefits.

What are buy now, pay later services?

Branded the modern-day layby, ‘buy now, pay later’ services essentially offer the same thing, except you get the product up front—the outfit, the watch, even certain domestic flights within Australia.

Services, such as Afterpay, Openpay and zipPay, are offered by approved retailers and provide another form of payment option when you’re shopping online and sometimes instore.

You can buy a product, take it home and pay for it in instalments via an online buy now, pay later account, which deducts your preferred debit or credit card.

Report findings

ASIC found around two million or 10% of Australians had used these services by mid-2018, a five-fold increase in two years. Most users are millennials or Generation Z, aged 18-34.

ASIC puts the spotlight on buy now, pay later, Nov 2018.

And they like the experience, with four in five of them planning to do so again. Although most users also believe that these arrangements allow them to buy more expensive items, smaller and more frequent spending is the norm. The value of average transactions over the period fell from over $1,000 to just under $180.

Only one out of the six major providers examined the income and existing debts held by consumers before providing their services. ASIC also received reports of instances where consumers used a buy now, pay later arrangement despite having limited or no income and substantial existing debt.

How do they charge?

Many buy now, pay later services are interest and fee free (if you pay on time). If a payment is scheduled to be deducted and you don’t have the money in your account, and haven’t attempted to pay what is owed via other means, you’ll typically be charged a late fee.

For this reason, it’s important you have the right amount of money in your account when each instalment is due, and that you’re across any other charges that might be payable before signing up.

According to buy now, pay later services, such as Afterpay, late fees aren’t a primary revenue driver, with the group saying that 80% of its revenue is derived from merchant fees paid by retailers2.

Another thing to consider, if you’re using your credit card, is while the buy now, pay later provider might not charge interest on your purchase, you may still have to pay interest to your credit card provider if you don’t pay the full amount owing on your credit card by the due date.

Things to consider

Price check your basket

Make sure you’re not paying more than you would if you shopped around. The Australian Securities and Investments Commission (ASIC) is considering the legal position of scenarios where a merchant inflates the cost of the underlying goods if a consumer uses a buy now, pay later arrangement.

Spending what you don’t have

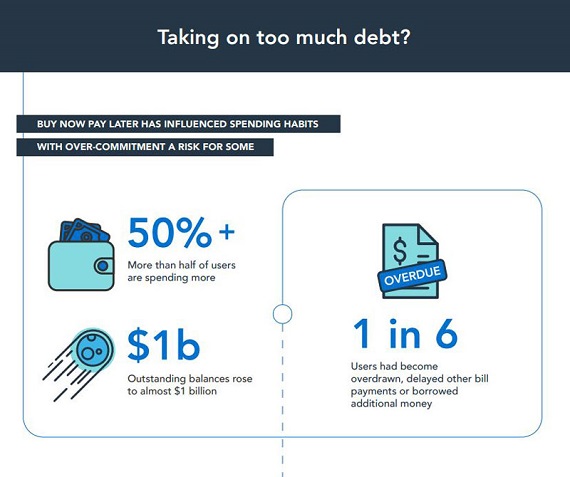

While these services can be very handy if you have available funds and can pay on time, if you don’t, little debts stemming from things like late fees can quickly snowball into bigger debts, which can have various repercussions. For this reason, it’s a good idea to have a budget in place when it comes to spending, so you don’t get in over your head.

ASIC puts the spotlight on buy now, pay later, Nov 2018.

Plan ahead – consider linking your account to a debit card instead of a credit card, so you don’t compound any missed payments.

How your credit rating could be affected

Many buy now, pay later services don’t check your ability to make repayments, so if you’re already in the red, further debt could mean bad news and possibly debt collectors at your door. On top of that, while buy now, pay later services might not check your history, they’re still able to report any black marks against you to credit reporting agencies, which could make it hard to borrow money in future.

If you have a customer complaint

Because you’re not going direct to the retailer when using a buy now, pay later service, you might also want to check out the provider’s dispute resolution policy so that there are no surprises if something you purchased doesn’t turn up, or you want to refund or return something that wasn’t quite right.

More information

Retail assistants may not fully understand the ins and outs of the products they’re selling. So, as with any financial contract, make sure you read it and understand the terms and conditions before you sign up to any new service provider. Ensure you’re across things like fees and various other policies so you don’t get caught out.

1 ASIC puts the spotlight on Buy Now Pay Later, released 28 November 2018

2 Afterpay Fact Sheet, p8

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling Ph 02 9899 9369, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person.