Lessons from 2019

Economic growth is slowing, but still growing

Following the Australian federal election in 2019, those of us who were optimistic about the outlook for Australian GDP growth were surprised at the extent to which the Reserve Bank of Australia (RBA) cut interest rates. However, these cuts were also in the context of weak consumer confidence, housing price instability and low wage growth which led to a generally flatter mood, driving growth lower. From a real estate perspective this has yielded mixed results.

On the one hand, slowing economic growth has had an impact on demand and rental growth as businesses and consumers choose to save rather than take on new space. But on the plus side, falling interest rates typically coincide with rising real estate values, which we saw in 2019 as investors exploit the gap between lower interest rates and their rental yield.

With returns for fixed income products falling to record lows, investors have favoured real estate’s average return of 9.8% for the year to December 2019 (MSCI/IPD Total Return Index), in order to generate the higher, more attractive returns for their portfolios.

Lower for longer and longer is the new normal

Falling interest rates and slowing economic growth have cemented this lower for longer and longer period of minimalist expansion which will arguably be the new “norm” going forward.

Prior to 2019, economic growth levels were pointing to renewed momentum, finally breaking free of the quantitative easing period that prevailed post the Global Financial Crisis. However, with growth levels so anaemic, quantitative easing – where the Reserve Bank becomes an active buyer of government and corporate bonds to inject liquidity into the economy – now looks like the most likely outcome.

This has driven returns on traditional savings products like term deposits and government bonds to new lows, forcing investors to move into other asset classes to generate income streams that can sustain their retirement lifestyle, or boost their savings.

Real estate investment cycle extended… but not all sectors benefited

Commercial real estate yields, which reflect the value of rent against the asset price, have been compressing consecutively since 2009, marking the longest growth cycle ever recorded (JLL REIS Data). We expect to see this cycle prolonged as investors chasing more attractive returns move into real estate and out of more liquid asset classes like equities and bonds.

The one exception to this rule in 2019 was the retail sector, which saw mixed results. There are multiple global forces driving down retail values – rising competition from e-commerce, shrinking investor appetite for exposure to the sector and changing consumer habits favouring less “shopping for stuff” in favour of experiences and convenience-based offerings.

While last year marked a turning point for retail, on a global basis, Australian retail still remains more competitively priced due to its scarcity and our robust population growth compared to the US and UK where retail valuations have been falling by as much as 40% (CBRE Research).

On balance, 2019 was a positive year for real estate investors. The risks and rewards became clearer as central banks responded to sluggish growth and improving capital values benefitted from low interest rates. We also saw risks on the demand side rising as consumer and business confidence hit record lows. With this in mind, where next for 2020?

Investment strategies for 2020

Residential

Residential is benefitting more than most real estate asset classes from the immediate effects of falling interest rates. With mortgages now priced below 3% in some cases, home buyers have plunged back into the market, reversing the pricing downturn of 2017-18.

With the prospect of more rate cuts in 2020, house values are anticipated to remain in positive growth territory for at least another one to two years.

Populous markets like Sydney and Melbourne remain the firm favourites to deliver the most stable growth over the medium term, however recovery markets such as Perth and Brisbane will offer investors more affordable entry points, with higher growth upside as these markets enter a sustained upswing beyond 2021.

Office

While office was the market leader for total returns, 2019 saw returns across most major markets decelerate as the impact of slowing economic growth created a drag on rental growth, particularly in Sydney and Melbourne.

While demand from tenants is expected to slow in 2020, rents should remain solid as there are no signs of a supply breakout before 2022.

Pricing in all office markets is also expected to rise this year, as global investor demand for Australian office product remains very strong.

Beyond the core markets of Sydney and Melbourne, which will still deliver strong, but slowing returns, the resource states of Brisbane and Perth remain on track for recovery led growth in the short to medium term.

Value add strategies, such as retrofitting older office stock and upgrading facilities in prime locations which remain highly prized by tenants for their amenity and offer good core fundamentals, are worth considering to generate higher returns and long term rental income.

Industrial and logistics

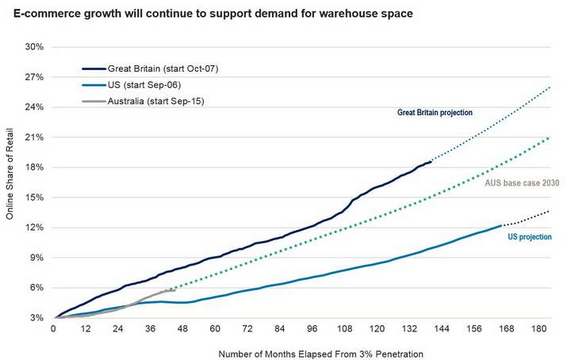

Logistics is expected to outperform all commercial real estate sectors in 2020, providing investors with the highest total returns in both capital and income growth. This is predicated on three key drivers:

-

Global demand for logistics assets from investors is already at record levels (refer to first chart below), as portfolios are re-weighted away from retail, which will provide short and long-term support to pricing;

-

Rental growth will benefit from an increasing sophistication of the tenant pool as it transitions from blue collar sectors to more technology enabled, consumer led products; and

-

The average price of an industrial asset is typically 80-90% lower than a retail or office asset, making it a highly liquid market. But with such strong competition for product, accessibility will be difficult.

In order to acquire logistics assets, investors can consider infill sites – older facilities with shorter lease terms in highly sought-after markets with rising land values or development sites in larger greenfield locations with longer lease terms and newer generation assets.

Another strategy gathering momentum is the repurposing of other property types for logistics use. Bulky goods retail or smaller shopping centres in strategic locations can make good conversion opportunities whilst delivering rental income over the medium term.

While 2020 is set to be logistics’ year to come out on top, not all logistics and industrial assets are created equal, so careful site selection and tenant vetting will be critical to minimise risk.

Retail

Turning to the retail sector, the new war for consumers is being spread between two distinct camps – convenience and experience.

The convenience end of the bell curve favours supermarkets, food services and other essential household services. This is why we have seen smaller format neighbourhood centres continue to show positive capital growth as investors seek low volatility, smaller more liquid assets.

On the experience side, this is where the super regionals dominate the market as they have the largest footprint and an array of offerings such as cinemas, restaurants, car parking and global fashion brands. Consumers will go here to have a social experience with their friends and also access their convenience services.

While pricing for retail on the whole will show some softening in 2020, it won’t be as much as we previously anticipated. Online sales, which currently account for 7% of all retail spend (ABS), will continue to challenge the bricks and mortar sector, but with 93% of our spend still in store, the overwhelming majority of our retail spending will remain in shopping centres for the foreseeable future.

Final thoughts

Overall the outlook for real estate is bifurcating – on the one hand, pricing growth will accelerate across most sectors in 2020, as the benefits of cheap debt and attractive returns keep investor demand levels high.

However, this optimism needs to be measured with a sober reflection on the weak fundamentals of the Australian economy, which continue to amplify the risks on the demand side.

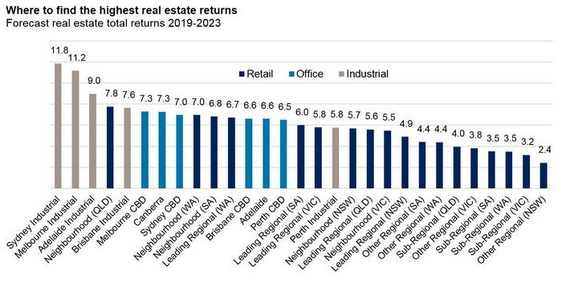

The good news is, the picture emerging is a lot clearer than in 2019, and despite a record growth cycle, the evidence suggests there is still more upside for real estate investors in 2020 and plenty of opportunities across sectors to find solid returns (refer second chart below).

Author: Luke Dixon, Head of Real Estate Research – Real Estate Sydney, Australia

Source: AMP Capital 18 Feb 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.