The transition towards net zero carbon emissions is shaping up to be a key investment theme of the next decade and we believe that no sector is more central to the transition than Australia’s mining industry.

The batteries that power electric vehicles and energy storage facilities are a core part of the energy transition – and their fundamental components, like lithium and nickel, are mined in Australia.

Government incentives and subsidies put in place as part of COVID stimulus packages, especially in Europe, have driven the price of electric vehicles (EVs) down to the same, or lower than, an equivalent petrol or diesel vehicle. Even without subsidies, EVs could be cheaper than internal combustion engine vehicles by as early as 20241.

This is a key turning point for consumers, who appear to be willing to make the switch to battery powered cars when the price is comparable to their internal combustion competitors.

This has driven a very quick uptake of EVs, which is fuelling demand for battery metals.

In Europe, registrations of electrically chargeable cars more than doubled to 7.5% of all car sales in the second quarter – up from 3.5% in 2020 – while plug-in hybrids made up 8.4% of all new cars sold and hybrid cars accounted for 19.3% of EU car registrations2.

In the US, take up is slower, but leading carmakers are aiming to achieve 40% to 50% market share of US sales volumes for electric vehicles by 20303.

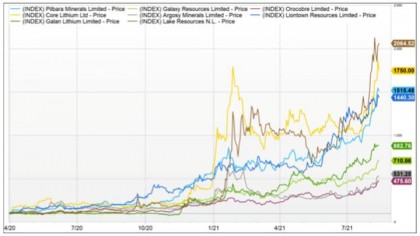

Lithium has been the headline winner.

Among a basket of eight leading Australian lithium stocks, the worst return from market bottom last year to now has been more than 400%. The best return from bottom to top has been more than 2000%4.

click to enlarge

Source: AMP Capital, FactSet.

The excitement in the sector is palpable and lithium is not the only metal attracting investor interest. Nickel, copper, cobalt and graphite are also seeing surging demand.

Nickel is another of the key materials for the energy transition and is also an important component of electric vehicle batteries.

And it is not only demand for the metals themselves that is driving share market valuations of mining companies.

A second factor driving share prices is the push towards responsible investing among the big super and pension funds who control billions of dollars of members’ money and are looking to divest fossil fuels and invest in driving lower carbon emissions.

The two factors combined have driven a structural re-rating of stocks exposed to these trends.

The drive to decarbonisation is also behind corporate activity in the mining and energy sector as companies prepare to face the challenge of energy transition.

Western Australia has seen a land grab for nickel-related assets as the mining companies scramble for assets.

The big miners are starting to align their portfolios with the decarbonisation trend and seeking to demonstrate their green credentials by offloading carbon intensive assets (such as BHP’s sale of their oil and gas division to Woodside5) and developing the key future-facing commodities like copper, lithium, nickel, cobalt and aluminium.

Part of the attractiveness of merging carbon intensive assets into larger operations is developing the scale required to fund carbon offset plans.

Still, it’s probably worth investors being wary of the call from some commentators that commodities are entering a new carbon-related ‘supercycle’ of sustained price rises.

It is true that decarbonisation is creating a pivot point for some commodities, however demand has been elevated over the past 18 months due to COVID-19 stimulus measures and the propensity for consumers to buy more ‘stuff’ given they are stuck at home.

This is unlikely to last in our opinion. Consumer demand in economies that are re-opening after the pandemic is likely to shift away from goods and move towards services as people start to travel and eat out again. We believe this could take the edge off demand for commodities.

Meanwhile, new supply is coming online, triggered in part by the high prices. There is no shortage of mining projects in the pipeline – the only question is how quickly they can come to market. There is an old saying in the mining industry that the cure for high prices is high prices – because they encourage new supply to come online and there is no reason to believe this time is any different.

That said, while a supercycle is unlikely, commodity prices do look well underpinned by the fundamentals of the big long-term structural stories, like electrification and decarbonisation. It is worth keeping an eye on the risks to the battery materials sector given its still in its infancy. While growth rates are projected to be very high, there are still factors to consider such as new battery technology leading to substitution to other materials, increasing battery efficiency, and alternative fuel sources such as hydrogen fuel cells and sodium ion batteries.

Unusually for this time in the cycle, high commodity prices have not driven the Australian dollar higher, which is under pressure from the COVID-19 lockdowns on the east coast. This means Australian miners are enjoying higher profitability.

This combination of high commodity prices and a lower Australian dollar is behind the fact that the mining sector was one of just two Australian market sectors that led earnings higher in the latest company reporting season (the other sector was banks). The mining performance was the central reason that Australian companies posted earnings around 10% higher than were in early 2020 despite the effect of the dilution from last year’s capital raisings6.

1. https://www.theguardian.com/environment/2020/oct/21/electric-cars-as-cheap-to-manufacture-as-regular-models-by-2024

2. https://www.acea.auto/fuel-pc/fuel-types-of-new-cars-battery-electric-7-5-hybrid-19-3-petrol-41-8-market-share-in-q2-2021/

3. https://www.whitehouse.gov/briefing-room/statements-releases/2021/08/05/statements-on-the-biden-administrations-steps-to-strengthen-american-leadership-on-clean-cars-and-trucks/

4. AMP Capital, FactSet

5. https://www.abc.net.au/news/2021-08-19/woodside-bhp-oil-gas-deal-analysis/100387720

6. FactSet

Author: Matt Griffin, Co-portfolio Manager, Small Caps Sydney, Australia

Source: AMP Capital 15 September 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.