– five reasons why we could still avoid recession

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Introduction

Over the last 18 months there has been much talk of recession globally and more recently in Australia. But, despite mild technical recessions (ie, two consecutive quarters of falling GDP in a row) in the US and Europe in the last 18 months, growth has generally been more resilient than expected and now with inflation falling many have started to give up on recession with increasing talk of Goldilocks (ie, where growth is okay and inflation is falling). So, have we dodged the recession bullet?

The case for a recession

The basic argument is that the most rapid monetary tightening in major countries in decades and cost-of-living pressures have set the scene for recession. This is supported by various signs that precede recessions:

-

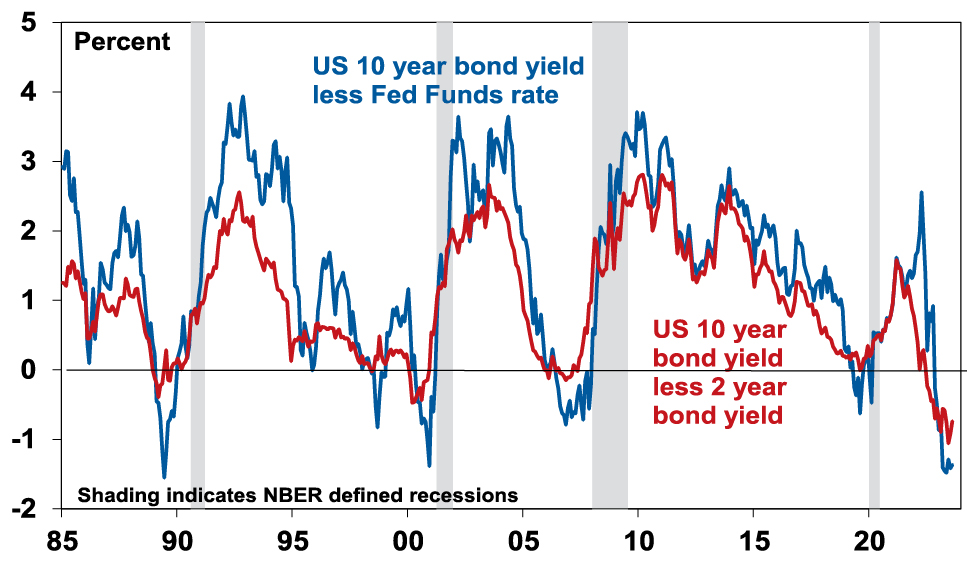

The US yield curve started to invert, with short term interest rates rising above long-term rates, last year. And this has preceded all US recessions over the last 60 years.

US yield curve inversions and recessions

Source: Bloomberg, AMP

-

Leading economic indexes – which combine things like building permits and confidence – are at levels that often precede recession.

-

Monetary conditions as measured by bank lending standards have tightened significantly and this normally leads to a collapse in lending.

And in Australia a record level of household debt servicing costs to income add to the local risk of recession which we put at 50%. But after “predicting” 4 of the last two recessions in Australia – one of which was the pandemic recession which flowed from lockdowns so shouldn’t really count – and seeing lots of incorrect forecasts of global doom over the years, I am all too aware of recession calls turning out to be wrong. Which partly explains my reluctance to go beyond 50/50 at present for Australia.

Can recession be avoided?

The first point to note is things like yield curves and leading indicators can get it wrong in forecasting recession. Yield curves have several issues:

-

The lag from yield curve inversion in the US can be 18 months. Various versions of it first inverted between July last year and January this year. So given normal lags it may not eventuate until next year.

-

More positively though US yield curve inversions have given false signals in the past, eg, in 1998.

-

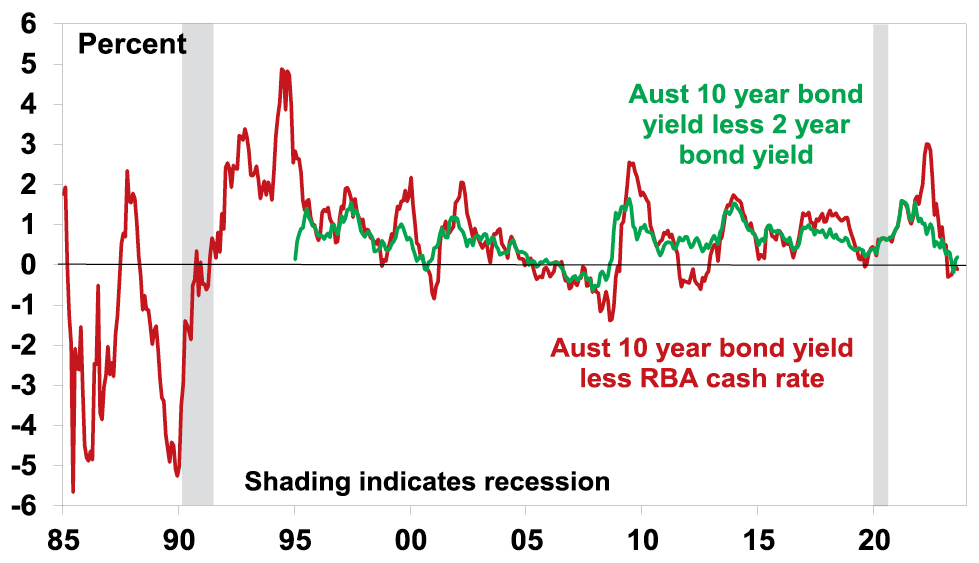

Inverted yields curves have been a poor indicator of recession since 1991 in Australia and right now it’s not decisively inverted anyway.

Australian yield curve inversions and recessions

Source: Bloomberg, AMP

There are in fact several ways a recession might still be averted.

First, inflation could fall fast taking pressure off rates

This could occur in several ways: easing goods supply pressures and transport costs could continue to reduce goods inflation; falling job vacancies and an easing in reopening demand could take pressure off wages growth and services inflation; and a productivity surge as Artificial Intelligence is deployed in services industries could do the same. In other words, today’s low unemployment levels could turn out to be consistent with “full employment” and only a marginal cooling in demand may be necessary to return labour and product markets to balance. And so central banks may soon be able to move towards lowering interest rates.

Recently the news on this has been good. US inflation has fallen from a peak of 9%yoy to 3% and Australian inflation has fallen from 8% yoy to 6%. And this has occurred without a rise in unemployment. Our US and Australian Pipeline Inflation Indicators continue to point down. However, there are several reasons to be cautious here.

-

First, services price inflation may prove a bit sticky as in some countries wages growth is still picking up. This is clearly a risk in Australia with a faster rise in minimum and award wages this year resulting in a renewed surge in labour costs in the latest NAB survey.

-

Second, AI will take years to enhance productivity growth.

-

Third, it assumes that central banks can fine tune the economic cycle – the RBA has done this well in the post 1991 period but the Fed not so well. This is made hard by lags in the way monetary policy impacts the economy which risks central banks raising rates too much. Having lost credibility last year in assuming inflation was “transitory”, central banks are likely to err on the side of caution to make sure the inflation dragon is back in its cave before easing up. And of course, this time around RBA tightening has been faster than at any time since the 1980s and household ratios are three times higher now.

But fortunately, there are also other ways recession may be avoided.

Second, there is a lack of excess to unwind

Recessions are normally preceded by imbalances that are unwound and lead to a sharp fall in economic activity. For example, in the US prior to the tech wreck there was an investment boom and prior to the GFC there was a boom in home building. However, this time around beyond the problem with inflation there are little in the way of similar excesses: there has been no business investment boom; there has been no home building boom and housing vacancy rates are low; household debt has fallen from its pre-GFC high; and inventory to sales ratios are low. So given the absence of excess, recession may be avoided or if not it’s likely to be mild.

It’s similar in Australia with the exception that household debt to income ratios are nearly double US levels leaving the Australian household sector as an obvious increased source of recession risk here – particularly with household debt servicing costs now pushing around record levels.

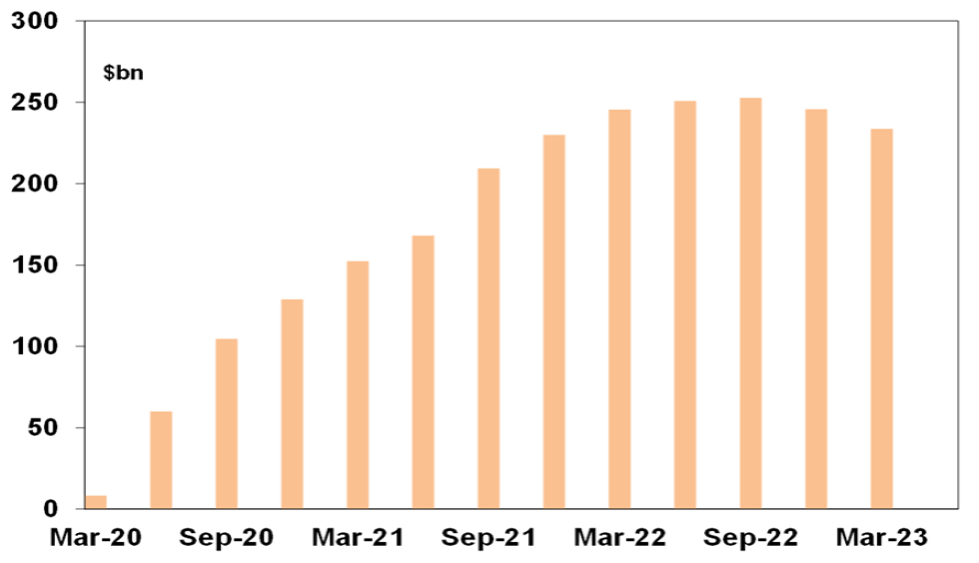

Third, households still have pandemic savings buffers

Through the pandemic people were constrained from spending but most still received an income. The result was that household saving rates rose above normal levels resulting in excess saving. See the next chart. In Australia it has been run down but remains high at around $230bn. My concern has been and remains that it is not distributed equally and that for many younger (25-45 year old) households with high debt levels it has been rundown such that it’s no longer of any support in the face of the surge in interest payments. And for older households they are unlikely to use much of it for spending anyway. Nevertheless, at an average level it is a source of support that wasn’t around prior to past downturns.

Australia Accumulated Household Savings

Source: ABS, AMP

Fourth, we could have rolling sectoral recessions

Different sectors of the economy are impacted at different times by shocks like tighter monetary policy. So various sectors of the economy may have “recessions” but at different times such that the overall economy never actually contracts. Something like this happened through the 1990s and 2000s to varying degrees providing support for the view that the environment back then was characterised by micro instability but overall macro stability and hence milder economic cycles.

In the US, in this cycle home building and technology, and more recently manufacturing, have arguably already had recessions but they are now starting to find a floor so if consumer spending on services turns down it may be offset by an improvement in home building, technology and manufacturing. Similarly in Australia, home building and retailing have been in recession for a while and conceivably could start to recover as consumer spending on services top out.

So far so good but the risk is high that currently weaker sectors don’t recover in time to offset weakness in lagging sectors like services.

Finally, strong population growth may mask recession

Strong population growth boosts demand and hence GDP growth and could enable a recession as defined as a fall in GDP to be avoided. In this regard it’s notable that while both the Australian Government and RBA are forecasting positive GDP growth this financial year on a year average basis at 1.5% and 1% respectively, this is expected to be below the rate of population growth at around 1.7% or more which means that both are forecasting a per capita (or per person) recession, but this is masked by strong population growth. Of course, what matters for living standards is per capita GDP growth but arguably for investors overall growth is more important as this is what will drive company profits.

Bottom line

Each of these considerations has qualifications but together they suggest recession can still be avoided. But it’s a high risk with the lagged impact of rate hikes still feeding through – particularly in Australia where we put the risk of recession at 50% given the vulnerability of the household sector. Weak growth in China is also adding to the risks of recession.

But what if growth is too strong?

Of course, the flipside is that we get too much of a good thing – growth takes off again before inflation has fallen back to earth. This would be a problem as it would likely mean a further fall in unemployment and so even tighter jobs markets, more upwards pressure on wages growth, higher for longer inflation and central banks keeping interest rates high for longer or even raising them further (to the point where recession comes anyway). This has been concerning investment markets in the last week or two with bond yields rising which has in turn has pressured share markets as higher bond yields make investment in shares look less attractive. This in turn has been made worse by:

-

Japan taking another mini step towards removing its ultra easy monetary policy and allowing a further rise in its bond yields which in time may reduce Japanese investment in US/global bonds; and

-

Fitch’s downgrade of US debt which has refocused attention on US’ high public debt and worsening budget deficit.

But while recession could still be avoided, a rebound in global & especially Australian growth seems unlikely until after central banks cut rates.

Implications for investors

We remain of the view that shares will do well on a 12-month view, but the risks around recession and higher bond yields mean that share market volatility will remain high with a high risk of a correction.

Source: AMP Capital August 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.